Argo Blockchain Stock: Is It a Smart Investment in the Crypto Revolution?

In the wild world of cryptocurrency, Argo Blockchain stock has emerged as a contender that’s caught the eye of savvy investors. With the blockchain revolution picking up steam, it’s no wonder people are curious about this digital gold rush. But is Argo the treasure chest or just another mirage in the desert?

Argo Blockchain Stock

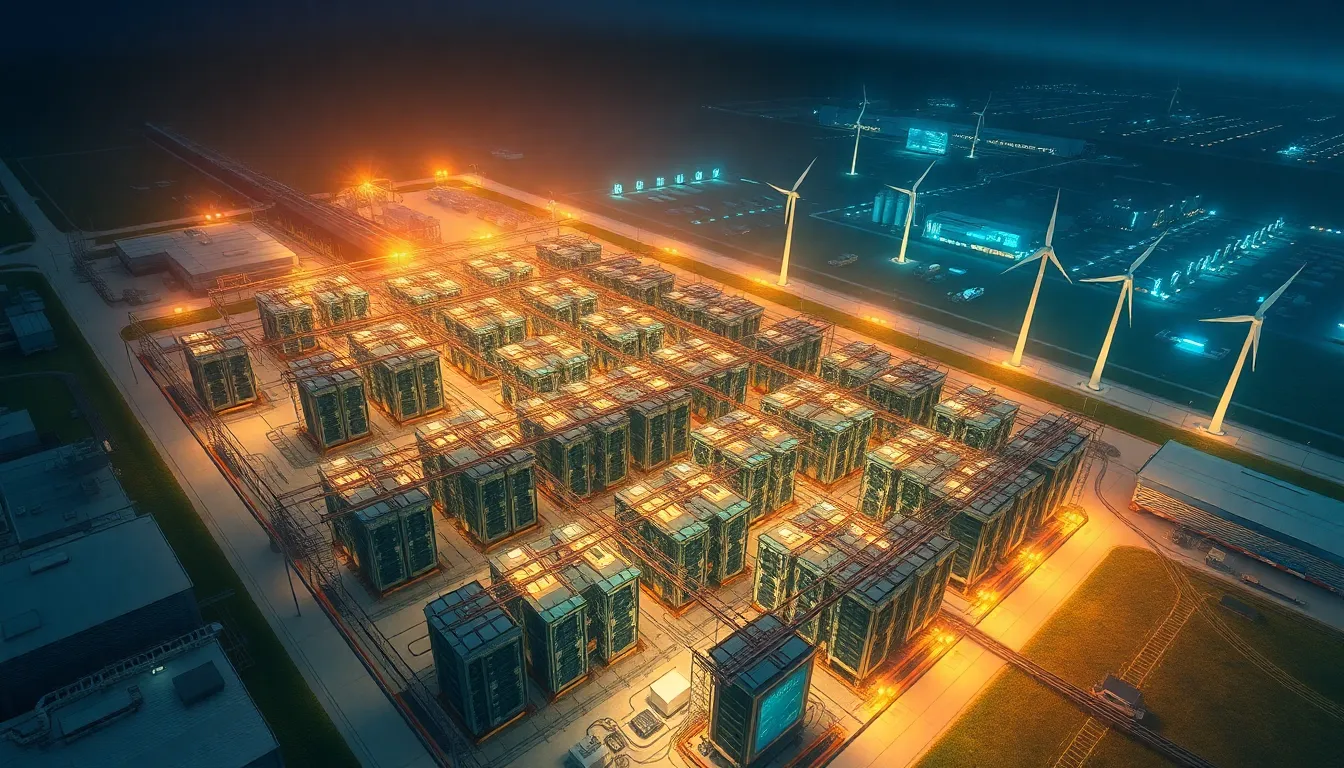

Argo Blockchain operates as a cryptocurrency mining company focused on Bitcoin and other digital assets. Established in 2017, it has positioned itself at the forefront of blockchain innovation. Investors often view Argo as a key player within the industry, thanks to its eco-friendly mining strategies.

The company utilizes renewable energy sources to power its operations, significantly reducing its carbon footprint. Such practices enhance its appeal to environmentally conscious investors. With its headquarters in London, Argo Blockchain maintains a strong presence in the global market.

In 2021, Argo launched its own mining facility located in Texas, expanding its operational capacity. This facility capitalizes on the state’s favorable energy conditions, enabling efficient mining activities. Notably, Argo’s stock performance has attracted attention due to its significant price fluctuations, reflecting overall trends within the cryptocurrency market.

Financially, Argo Blockchain has shown growth potential, reporting increased revenue linked to higher Bitcoin prices. Earnings and operational metrics contribute to investor interest as they monitor the stock’s performance. The company’s ability to adapt to market dynamics remains crucial for its long-term viability.

Recent collaborations with other blockchain technologies indicate Argo’s commitment to innovation. Partnerships strengthen its market position and enhance its service offerings. Overall, Argo Blockchain represents a compelling investment opportunity amid the evolving landscape of cryptocurrency.

Financial Performance of Argo Blockchain Stock

Argo Blockchain’s financial performance demonstrates notable trends crucial for investors. As a player in the cryptocurrency mining sector, its fiscal metrics reflect both market conditions and company initiatives.

Revenue Trends

Argo Blockchain has experienced fluctuating revenue, primarily influenced by Bitcoin price changes. For example, in 2020, the company’s revenue reached $19 million, a significant rise from the previous year. Increased Bitcoin mining operations contributed to this surge. Analysts noted a direct correlation between Bitcoin prices and revenue growth, highlighting this dynamic. In the latter part of 2021, revenue jumped by over 300% driven by higher mining volumes. Recent revenue reports show a decline, mainly due to market adjustments and operational challenges. Despite these fluctuations, investors still view the overall revenue trajectory as promising.

Profit Margins

Profit margins at Argo Blockchain reflect the company’s operational efficiency and the volatile nature of cryptocurrency markets. In Q2 2021, the company recorded a gross profit margin of approximately 83%. This high margin indicates effective cost management and strategic investments in mining technology. Operational expenses constitute a significant portion of overall costs, impacting net profits. For instance, increased electricity costs in Texas have affected margins recently. Nevertheless, Argo’s commitment to utilizing renewable energy sources mitigates some financial pressures. Analysts predict improved profit margins as the company enhances its technology and reduces costs over time.

Market Position and Competition

Argo Blockchain holds a distinct position in the cryptocurrency mining sector. The company emphasizes eco-friendly mining strategies, which resonate with socially conscious investors. Competitors in the market include Riot Blockchain and Marathon Digital Holdings, both of which also focus on Bitcoin mining but may not prioritize sustainability to the same extent.

Recent collaborations with other blockchain companies illustrate Argo’s commitment to innovative practices, setting it apart from rivals. The mining facility in Texas enhances operational capacity, benefiting from competitive energy prices compared to other regions. Expansion into favorable markets contributes to the company’s competitive edge, allowing it to capture a larger share of the market.

Price fluctuations in cryptocurrency significantly influence the competitive landscape. Argo’s stock performance reflects broader market trends, with substantial price changes associated with Bitcoin. This volatility creates both challenges and opportunities, as the company’s performance varies with market conditions.

Financial growth potential appears strong, with Argo’s revenue peaking at $19 million in 2020. The increase of over 300% in late 2021 highlights the impact of boosting mining volumes. Declining recent revenues can be attributed to market adjustments and operational challenges, a common issue faced by industry players.

Profit margins at Argo reflect efficiency amidst market volatility, demonstrating a gross profit margin around 83% in Q2 2021. Rising operational costs, especially electricity, present challenges that competitors also encounter. Commitment to renewable energy aids in reducing some financial pressures, aiding long-term competitiveness as technology continues to advance.

Investment Insights

Argo Blockchain stock presents a complex investment landscape characterized by unique opportunities and challenges. Investors often weigh various factors influencing their decisions.

Risk Factors

Volatility in cryptocurrency markets represents a crucial risk factor. Price swings can lead to significant value losses in short periods. Operational costs, particularly electricity prices in Texas, add financial strain, potentially affecting profit margins. Regulatory changes in cryptocurrency mining also create uncertainties, as governments may impose new laws impacting operations. Market competition remains intense, with established companies like Riot Blockchain and Marathon Digital Holdings vying for market share. These players may aggressively pursue innovations, creating pressures for Argo to remain competitive.

Potential for Growth

Sustainable practices give Argo a potential growth edge in the evolving market. The company’s focus on renewable energy aligns with the increasing demand for environmentally responsible investments. Expanding operational capacity in Texas facilitates greater mining output, positioning Argo to capture rising Bitcoin prices. Collaborations with emerging blockchain technologies indicate an innovative approach, fostering diversified revenue streams. Analysts anticipate tech advancements may enhance operational efficiencies, leading to improved margins over time. Positive trends in institutional interest toward cryptocurrencies further signal favorable conditions for growth, suggesting Argo may thrive in this transformative market.

Recent Developments

Recent fluctuations in Argo Blockchain’s stock reflect broader trends in the cryptocurrency sector. In mid-2023, the company reported a revenue of $12 million for the first quarter, a decrease compared to the previous year’s figures. This decline demonstrates the volatility that often impacts cryptocurrency-related businesses, influenced primarily by Bitcoin’s price movements.

Argo Blockchain made headlines by announcing its intention to further expand its facilities in Texas, aiming to leverage the state’s renewable energy resources. This strategic move aligns with its commitment to eco-friendly mining practices. Analysts speculate that such developments may position Argo favorably against competitors, reinforcing its market share.

Collaboration with leading blockchain technologies continues to enhance Argo’s operational capacity. By partnering with innovative firms, Argo seeks to integrate advanced mining techniques that increase efficiency. These partnerships signal a proactive approach to maintaining competitiveness in a rapidly evolving marketplace.

Investors are closely monitoring Argo’s financial metrics. In Q2 2023, the gross profit margin experienced improvement, reaching approximately 85%. This uptick is attributed to better energy management strategies, countering previous operational cost pressures.

The company faces challenges from rising operational costs and increasing competition. Competitors like Riot Blockchain often invest heavily in marketing and advanced tech, placing pressure on Argo to innovate continuously. Nevertheless, Argo’s focus on sustainability resonates with a growing pool of socially responsible investors eager to support eco-conscious initiatives.

Institutional interest in cryptocurrency investments remains robust, providing potential long-term benefits for companies like Argo. Analysts observe a trend towards increased allocations in crypto assets among large institutions, which could bode well for Argo Blockchain’s future growth potential.

Conclusion

Argo Blockchain stands out in the rapidly evolving cryptocurrency landscape. Its commitment to eco-friendly mining practices and expansion into favorable energy markets positions it uniquely among competitors. While recent revenue fluctuations highlight the inherent volatility of the sector, the company’s focus on innovation and operational efficiency suggests a promising outlook.

Institutional interest in cryptocurrencies continues to grow, offering potential long-term advantages for Argo. As the market matures and technology advances, Argo Blockchain could solidify its role as a key player. Investors should weigh the opportunities against the risks, but the company’s strategic initiatives present a compelling case for consideration in a diversified investment portfolio.